Arrowhead Pharmaceuticals, Inc. (ARWR) is an innovative biotechnology company based in Pasadena, California. It specializes in developing RNA interference (RNAi) therapeutics, a novel technology that targets specific genes responsible for diseases. The company’s pipeline focuses on treating a variety of conditions, including liver diseases, cardiovascular diseases, and genetic disorders. With a promising set of drug candidates and a strong scientific foundation, Arrowhead Pharmaceuticals has captured the attention of the investment community.

This article offers a comprehensive look at ARWR stock price, examining its historical performance, factors influencing its price, and potential future developments. We will also explore the broader biotechnology market and provide insights into investing in ARWR stock price.

Company Overview: Arrowhead Pharmaceuticals

Arrowhead Pharmaceuticals was founded in 2007 and has since become a leader in RNA interference (RNAi) therapeutics. RNAi technology has the potential to transform medical treatment by silencing disease-causing genes at the genetic level, offering a new way to treat diseases that were previously considered untreatable with traditional methods. The company’s research focuses on addressing major health concerns such as liver diseases, cardiovascular conditions, and even certain types of cancers.

Arrowhead’s most advanced drug candidates are in clinical trials, and their progress will determine the company’s future and, by extension, its ARWR stock price. The company operates with the belief that RNAi has the ability to revolutionize the treatment of genetic diseases, and the technology could provide breakthroughs in treating conditions like hepatitis B, familial hypercholesterolemia, and obesity.

ARWR Stock Price Overview

The ARWR stock price has fluctuated over the years, reflecting both the company’s scientific progress and the broader biotechnology market conditions. As of January 10, 2025, ARWR stock price stood at $18.49, marking a decline of 6.38% from the previous close. This pullback follows a period of significant price volatility, underscoring the risks and rewards of investing in biotech stocks.

The ARWR stock price has experienced periods of substantial gains, particularly when Arrowhead announced breakthroughs or positive clinical trial results. For instance, ARWR stock price saw a massive surge of 159% in October 2024, driven by investor enthusiasm over its RNAi platform’s potential. However, the ARWR stock price has since retraced its gains as the company faces the uncertainties typical of biotech companies, such as trial outcomes and regulatory decisions.

Despite this volatility, ARWR stock price has shown resilience, and investors continue to monitor the company’s progress with cautious optimism. The ARWR stock price is heavily influenced by the company’s clinical trials, partnerships, and regulatory filings, with positive developments driving up the ARWR stock price, while setbacks or delays lead to declines.

Historical Stock Performance

ARWR stock price has mirrored the company’s development and milestones. In its early years, the stock price was relatively stable, reflecting the initial challenges of establishing the company’s RNAi technology. However, in 2014, the ARWR stock price began to see more significant movement, spurred by positive trial results and growing recognition of the potential of RNAi-based therapies.

The ARWR stock price experienced a major rally in 2018 after Arrowhead announced the successful development of a treatment for Hepatitis B using RNAi technology. This announcement brought the company into the spotlight, leading to a rise in its ARWR stock price. However, after the initial surge, ARWR stock price began to retract, as market conditions and investor sentiment fluctuated.

In 2020, Arrowhead saw a renewed interest from investors, driven by successful results from clinical trials and the continued progress of its pipeline. However, as with many biotech stocks, ARWR stock price performance was marked by ups and downs, influenced by both internal trial results and the broader market sentiment.

Key Factors Influencing ARWR Stock Price

The ARWR stock price is subject to a variety of factors, many of which are inherent in the biotech sector. The most significant factors influencing ARWR stock price include:

Clinical Trial Results

ARWR stock price is directly influenced by the outcomes of its clinical trials. The company’s pipeline includes a range of drug candidates in different stages of development. Positive data from Phase 1, Phase 2, and Phase 3 trials can lead to sharp increases in ARWR stock price. Conversely, disappointing results or failures in clinical trials often result in ARWR stock price declines. The success or failure of Arrowhead’s drug candidates in clinical trials remains a key determinant of its ARWR stock price.

FDA Approvals

The approval of new therapies by the U.S. Food and Drug Administration (FDA) is another crucial driver of ARWR stock price. The FDA’s endorsement of a new drug is seen as a major milestone for biotech companies, as it validates the safety and efficacy of the therapy. In Arrowhead’s case, if its RNAi therapeutics are approved by the FDA, the company could gain significant revenue from product sales. On the other hand, delays or rejections from the FDA could lead to negative ARWR stock price movements.

3. Market Sentiment

Biotech stocks like ARWR stock price are often affected by the overall market sentiment toward the industry. Positive sentiment toward biotechnology stocks in general can drive ARWR stock price upward, while negative sentiment, such as a market-wide sell-off, can lead to declines. Market sentiment is influenced by factors such as the performance of other biotech companies, broader economic conditions, and investor appetite for risk.

4. Strategic Partnerships and Collaborations

Arrowhead’s ability to secure strategic partnerships with larger pharmaceutical companies, academic institutions, or other organizations can also affect ARWR stock price. Partnerships provide Arrowhead with additional resources, funding, and expertise that can accelerate the development of its RNAi therapies. For instance, the company’s 2023 collaboration with Janssen Pharmaceuticals, a subsidiary of Johnson & Johnson, to co-develop RNAi therapies for liver diseases was viewed as a positive development. These partnerships may boost investor confidence and contribute to ARWR stock price growth.

5. Investor Speculation

Biotech stocks are often subject to speculative trading, as investors bet on the future potential of drug candidates and technologies. This speculative nature can result in significant price swings based on news events, clinical trial results, and other factors. While speculation can lead to large price gains, it also increases the volatility of ARWR stock price, making it a higher-risk investment.

Recent Developments and Milestones

Arrowhead Pharmaceuticals has made significant strides in its development pipeline, with recent positive developments influencing ARWR stock price:

Positive Clinical Trial Data

In June 2024, Arrowhead reported successful results from its pivotal Phase 3 PALISADE study of Plozasiran, an RNAi-based therapy designed to treat familial chylomicronemia syndrome (FCS). The study demonstrated that Plozasiran significantly reduced triglyceride levels in patients with FCS, achieving the primary endpoint. This success provided a boost to ARWR stock price, signaling the potential for the therapy to receive FDA approval and reach the market.

New Drug Candidates and Expanding Pipeline

Arrowhead continues to expand its pipeline with promising new drug candidates. In June 2024, the company presented preclinical data on ARO-INHBE, a novel RNAi therapy designed to treat obesity and metabolic diseases. The preclinical results showed that ARO-INHBE could significantly reduce body weight and improve insulin sensitivity, making it a potential game-changer in the treatment of obesity. If these results are replicated in clinical trials, ARO-INHBE could be a major contributor to Arrowhead’s growth and revenue in the future.

Partnership with Janssen Pharmaceuticals

In addition to its internal development efforts, Arrowhead has entered into strategic collaborations to enhance its research and development efforts. In 2023, the company announced a partnership with Janssen Pharmaceuticals to co-develop RNAi-based therapies for liver diseases. This collaboration provides Arrowhead with the resources and expertise of a global pharmaceutical leader, enhancing its ability to bring its therapies to market. Such partnerships are viewed positively by investors, as they help mitigate the risks associated with drug development, positively influencing ARWR stock price.

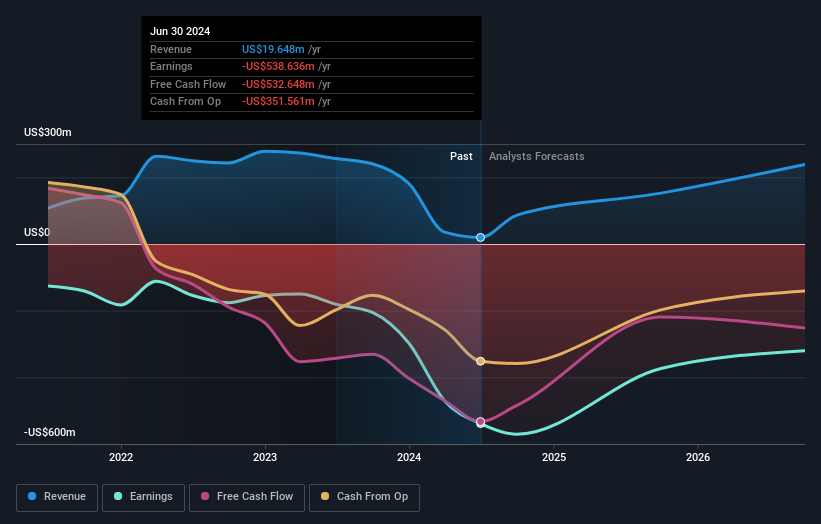

Financial Overview of ARWR

Arrowhead Pharmaceuticals is still in the early stages of generating significant revenue from its RNAi therapies, as most of its products are still in clinical trials. As of September 2024, Arrowhead’s market capitalization stood at approximately $6.58 billion, reflecting investor optimism about the company’s pipeline and future growth potential. However, ARWR stock price remains heavily dependent on the successful commercialization of its drug candidates.

Valuation Metrics

The price-to-earnings (P/E) ratio for ARWR stock price stands at 11.70, which is relatively low for a biotech company. This low valuation suggests that the market may not fully appreciate the company’s growth potential, especially if its clinical trials and drug approvals continue to show positive results. Similarly, Arrowhead’s price-to-sales (P/S) ratio is 0.23, indicating that the company may be undervalued relative to its revenue potential.

Despite the promising prospects, ARWR stock price has yet to generate significant revenue from its therapies. The company’s financial performance remains tied to the success of its clinical trials and the regulatory approval process. As Arrowhead progresses through these stages, its ARWR stock price will likely experience fluctuations based on trial outcomes and market conditions.

Future Outlook for ARWR Stock Price

Looking ahead, the future of ARWR stock price largely hinges on the company’s ability to successfully develop, test, and bring its RNAi therapeutics to market. If the company can achieve FDA approval for its leading drug candidates, it could unlock significant revenue potential and drive substantial ARWR stock price appreciation.

The most promising asset in Arrowhead’s pipeline is Plozasiran, which has already shown success in clinical trials. If the therapy is approved by the FDA and other regulatory agencies, it could become a commercial success. Additionally, Arrowhead’s expanding pipeline, including therapies for obesity, cardiovascular diseases, and other conditions, provides a strong foundation for future growth.

However, biotech investments are inherently risky, and ARWR stock price is no exception. Clinical trial failures, regulatory delays, and unforeseen challenges in the development process could negatively impact the ARWR stock price. As such, investors should carefully monitor Arrowhead’s progress and make decisions based on the latest clinical and financial updates.

Arrowhead Pharmaceuticals remains a leading player in the biotechnology sector, with its RNAi platform offering significant potential to transform the treatment of genetic diseases. The company’s ARWR stock price has been volatile, influenced by both positive and negative news related to its clinical trials, FDA approvals, and market sentiment.